As an expat living outside the UK, planning for retirement can be a challenge. However, finding the best International SIPP provider can provide the flexibility and control you need. In this guide, we will explore the best UK SIPPs available for expats, including insights into International SIPP providers. We will dive into key considerations such as fees, investment options, and provider reputation. By the end, you’ll be equipped with the knowledge to make an informed decision for your retirement savings.

Introduction to International SIPP

An International SIPP (Self-Invested Personal Pension) is a type of pension scheme designed for non-UK residents, offering a flexible and tax-efficient way to manage UK pension benefits. It allows individuals to take control of their retirement savings, providing access to a wide range of investment options, including mutual funds, exchange-traded funds, and investment trusts. International SIPPs are regulated by the UK’s Financial Conduct Authority, ensuring compliance with UK pension and tax rules. As a non-UK resident, it’s essential to seek professional financial advice to understand the benefits and implications of an International SIPP for your retirement planning.

Understanding Self Invested Personal Pension (SIPPs)

A Self-Invested Personal Pension (SIPP) is a retirement savings vehicle that allows individuals to take control of their pension investments. SIPPs offer flexibility in choosing a retirement income option, including annuity purchase or flexible withdrawals. SIPPs also provide a broad array of investment options, including investment trusts, mutual funds, ETFs, and shares. This freedom makes SIPPs an attractive option for expats who want to manage their own pension funds, have a wider range of investment choices, and take control of their own investment decisions.

Benefits of International SIPP for Expats

International SIPPs offer numerous benefits for expats, including flexibility in managing pension investments, tax benefits, and access to global investment options. They provide a tax-efficient way to manage UK pension benefits, allowing individuals to consolidate existing UK pensions into one account. International SIPPs also offer the ability to hold assets in multiple currencies, reducing the risk of currency fluctuations. Additionally, they provide a regular or variable income in retirement, and the option to pass on pension funds to beneficiaries without incurring UK inheritance tax. Expats should consult a financial adviser to determine if an International SIPP is suitable for their individual circumstances and to understand the local tax implications.

Tax Benefits of SIPPs for Expats

Expats can benefit from SIPPs in several ways. Firstly, SIPPs provide a diverse range of investment options, including stocks, funds, bonds, and cash, allowing individuals to tailor their portfolios to their risk tolerance and financial goals. Utilising an International SIPP can help manage pensions and secure a comfortable financial future for expats. Secondly, SIPPs offer flexibility in managing investments, allowing expats to actively make investment decisions or seek professional advice. Lastly, SIPPs provide tax efficiency and tax advantages, with tax-free growth and the ability to withdraw funds based on the tax regulations of their country of residence.

Comparing SIPP Providers

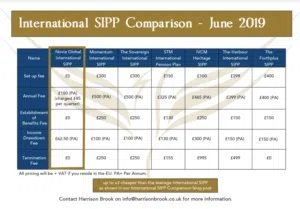

When choosing an international SIPP provider, it’s essential to compare factors such as fees, investment choices, and customer service. It is also crucial to review and adjust your investment strategy when selecting a SIPP provider. Some popular SIPP providers for expats include Novia Global, Invinitive, IFGL and iPensions. Consider low-cost providers that offer a wide range of investment options and competitive fees. It’s also important to seek professional financial advice and choose a provider with a solid reputation and excellent customer service to ensure a smooth and reliable experience.

Fees and Charges | Best UK SIPP for Expats

Fees and charges associated with SIPPs can vary significantly between providers. When evaluating fees, consider factors such as annual management fees, investment charges, platform fees, and potential exit fees. Look for providers that offer transparent fee structures and competitive pricing. Keep in mind that while low-cost providers may offer attractive fees, it’s crucial to assess the overall value provided, including investment choices, customer service, platform functionality, and the potential impact on future tax liabilities. Also, consider the costs and complexities involved in a pension transfer, as these can significantly affect your financial planning.

Exploring Investment Options

SIPPs offer a wide range of investment options to suit varying investment strategies and risk appetites. Investment funds within SIPPs provide expats with a more diverse array of global investment options compared to traditional domestic SIPPs. Consider options such as individual stocks, mutual funds, exchange-traded funds (ETFs), bonds, and cash holdings. For those seeking investment ideas, there are resources like managed funds and starter portfolios to guide both experienced and novice investors in making informed choices. Diversification is key, so aim to build a portfolio that spreads investments across different asset classes. Research the global investment options available through each SIPP provider and assess whether they align with your investment goals and risk tolerance.

Creating an Investment Strategy

When creating an investment strategy for an International SIPP, it’s crucial to consider individual financial goals, risk tolerance, and time horizon. A diversified investment portfolio can help mitigate risk and maximize returns. Investment options may include mutual funds, exchange-traded funds, investment trusts, and other assets. It’s essential to seek professional advice from a financial adviser to construct a portfolio that aligns with your investment objectives and risk profile. Regular reviews and monitoring are necessary to ensure the investment strategy remains on track and to make adjustments as needed. By creating a well-structured investment strategy, individuals can optimize their retirement savings and achieve their financial goals.

Tips for Selecting the Right SIPP

When selecting the best UK SIPP for expats, consider these essential tips:

Define your retirement goals. Determine your financial objectives, desired retirement age, and income needs to choose a SIPP that aligns with your plans.

Prioritize financial planning. Financial planning is crucial for expats managing their financial future. Understanding the implications of various financial decisions and working with qualified advisers can help craft tailored financial planning solutions.

Assess your risk tolerance. Evaluate how comfortable you are with investment risks and select a SIPP that offers suitable investment options for your risk profile.

Compare fees and charges. Look beyond the headline fees and analyze the complete fee structure, including annual charges, transaction fees, and any additional costs.

Research provider reputation. Consider the reputation and track record of SIPP providers, including their financial stability and customer reviews.

Evaluate customer service. Assess the quality and responsiveness of customer service, as it is important to have reliable support when managing your SIPP.

Seek expat financial advice. Utilising specialised services for expat financial advice ensures the process of transferring pensions into an International SIPP is managed correctly and transparently. Working with experts can help expats make informed decisions regarding their financial transitions and provide tailored investment advice to enhance understanding of tax implications and optimal strategies for managing retirement savings.

International SIPP Rules and Regulations

International SIPPs are subject to UK pension and tax rules, and individuals must comply with these regulations. The UK’s Financial Conduct Authority regulates International SIPPs, ensuring they meet specific standards. Non-UK residents must understand the tax treatment of their International SIPP, including the potential impact of UK tax relief and local tax implications. It’s essential to seek professional advice from a financial adviser to navigate the complexities of International SIPP rules and regulations.

Consolidating Pension Pots with International SIPP

Consolidating existing UK pensions into an International SIPP can simplify retirement planning and provide a more efficient way to manage pension savings. By combining multiple pension pots into one account, individuals can reduce administration fees, minimize complexity, and optimize investment returns. International SIPPs offer a flexible and tax-efficient way to consolidate pension funds, allowing individuals to take control of their retirement savings. However, it’s crucial to seek professional advice from a financial adviser to determine the best course of action for individual circumstances and to ensure compliance with UK pension and tax rules. By consolidating pension pots with an International SIPP, individuals can create a more streamlined and effective retirement plan.

Best UK SIPP for Expats

Choosing the best UK SIPP for expats who plan to retire abroad involves considering factors such as fees, investment options, and provider reputation. It is crucial to seek professional financial advice to ensure that your individual circumstances and needs are thoroughly evaluated. By understanding the advantages of SIPPs, analysing fees and investment choices, and following essential tips, you can make an informed decision that aligns with your retirement goals.

Contact Harrison Brook today and let our dedicated team guide you towards a secure and prosperous retirement.