Introduction to International High Net Worth Financial Advice

In the rapidly evolving global financial landscape, high net worth individuals (HNWIs) require specialised guidance and tailored solutions to navigate the complexities of managing their wealth across borders. At Harrison Brook, we offer comprehensive international high net worth financial advice, empowering our clients to optimise their financial strategies and capitalise on global opportunities.

The Significance of International High Net Worth Financial Advice

In today’s interconnected world, HNWIs seek a cross-border regulated savings and investment solution that provides them with flexibility, control, and access to a diverse range of financial products. Our expertise lies in offering International High Net Worth Financial Advice, which enables clients to leverage regulated investments and maintain portfolios in multiple currencies through our UK FCA regulated solution.

The Power of Global Investment Accounts (GIAs)

What is a Global Investment Account (GIA)?

A Global Investment Account (GIA) serves as a versatile investment tool for international clients worldwide. This account allows HNWIs to harness the benefits of regulated investments while offering the convenience of holding assets in various currencies. With our UK FCA regulated GIA solution, you gain control over your investment portfolio, and our qualified financial advisers are readily available to guide you through the process.

Why Choose a Global Investment Account (GIA) with Harrison Brook?

By choosing to open a Global Investment Account (GIA) with Harrison Brook, you gain access to a user-friendly online platform that offers an extensive range of international financial products and services. Our commitment to transparency ensures that you have full visibility into the performance of your savings and investments. Additionally, our team of expert financial advisers provides personalised guidance to ensure your money works for you.

Unlocking the Potential of UK SIPPs

Understanding UK SIPPs

UK Self-Invested Personal Pensions (SIPPs) are highly flexible retirement plans that grant individuals the autonomy to make their own investment decisions while saving for their future. These pensions offer a wider range of investment choices, tax benefits, and currency options, empowering HNWIs to tailor their retirement strategies according to their unique circumstances.

Benefits of UK SIPPs

With UK SIPP, you can consolidate your UK pension benefits seamlessly, even if you reside outside of the UK. This flexible pension solution allows for regular or variable income through flexi-access drawdown, without the mandatory purchase of an annuity. Moreover, it enables you to hold assets that cater to the needs of international clients while complying with the regulatory standards set by the UK’s Financial Conduct Authority (FCA).

Choosing the Right Financial Path: International SIPP vs. QROPS

UK SIPP vs. QROPS: Understanding the Distinctions

Both UK SIPPs and QROPS cater to expats with UK pension rights. However, they differ in suitability based on individual circumstances. Firstly, QROPS are advantageous for individuals with substantial pension funds, mitigating tax liabilities. On the other hand, UK SIPPs offer flexibility and investment choices for a wider range of expats. Therefore, it’s important to consider your financial situation and goals when choosing between them. Ultimately, consulting a specialized financial adviser can provide valuable guidance in making the right decision.

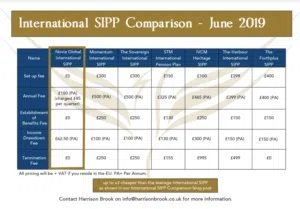

UK SIPP Comparison: Cost-Effective Solutions

At Harrison Brook, we provide UK SIPPs with transparent and competitive fee structures. Our pricing, which is significantly lower than the average in the market, ensures cost efficiency without compromising on the quality of our services. We believe in explaining all fees clearly from the outset, enabling you to make informed decisions about your pension transfer.

The Seamless Pension Transfer Process with Harrison Brook

Transferring your existing pension into an UK SIPP necessitates a meticulous and efficient process. At Harrison Brook, we ensure a seamless transition by offering transparent advice and adhering to recognised and approved schemes. Our independent financial advisers, specialised in cross-border financial advice, will guide you through each step. With their expertise, you can confidently navigate the complexities of cross-border pension transfers.

International High Net Worth Financial Advice

In the realm of international high net worth financial advice, Harrison Brook stands as a trusted and approachable partner. Firstly, we are dedicated to gaining your trust by providing personalised financial planning and transparent services. Additionally, with our expertise in International High Net Worth Financial Advice, we help you maximise cross-border wealth potential. Moreover, we offer comprehensive knowledge of Global Investment Accounts (GIAs) and UK SIPPs, providing tailored solutions to suit your needs. With these resources at your disposal, you can confidently navigate the complexities of international finance and make informed decisions. Furthermore, by leveraging these tools, you can seize opportunities and grow your wealth on a global scale. Therefore, trust us to guide you towards financial success. Furthermore, you can experience the benefits of our comprehensive range of services and transparent fee structures. Lastly, embark on your financial journey with Harrison Brook and unlock your wealth potential.