For many, the opportunity to retire abroad is an enticing prospect. Whether it’s the allure of a warmer climate, stunning natural surroundings, or the potential financial benefits (such as lower taxes or living costs), retiring abroad can seem like a dream come true. However, realising this dream requires careful financial planning, especially if you intend to remain abroad for good. Your pension is central to this plan, so it’s crucial to ask: Is your UK pension big enough to retire abroad?

Factors Affecting Pension Adequacy

1. Cost of Living

Understanding the cost of living in your chosen destination is vital. While some countries or regions may offer a lower cost of living compared to the UK, others may not. Conduct thorough research, considering not just daily expenses, but also healthcare, insurance, and lifestyle costs that might not be immediately apparent.

2. Currency Exchange Rates

Currency exchange rates can have a significant impact on your pension’s purchasing power. While you may know the value of your pension in pounds, fluctuations in exchange rates can either enhance or diminish its value when converted to another currency. If your pension is denominated in pounds but your expenses are in euros, dollars, or another currency, it’s important to account for potential exchange rate volatility.

3. Healthcare Costs

Healthcare is a critical factor in retirement, particularly as we age. In some countries, state healthcare may not be as comprehensive or affordable as in the UK. Private health insurance could be necessary, which might significantly impact your retirement budget. Planning for these expenses ahead of time is essential to avoid depleting your pension savings.

4. Tax Implications

Taxation is another crucial consideration. The tax rules for pensions can vary depending on your country of residence, and double taxation treaties between the UK and your new home may affect where and how much tax you pay. Financial planning can help structure your assets and income streams in the most tax-efficient way, potentially saving you substantial amounts of money over the course of your retirement.

5. Pension Accessibility

It’s not uncommon for UK pension providers to restrict access to your UK pension if you live overseas. Some expats find themselves faced with the choice of withdrawing their entire pension in one lump sum, which can lead to a hefty tax bill, or transferring it to another scheme such as a QROPS or an International SIPP. Consulting a qualified financial adviser like Harrison Brook is crucial to explore these options and avoid potentially costly mistakes.

Calculating Your Retirement Income

As you approach retirement, it’s likely that your wealth will be spread across various assets including bank accounts, investments, property, and pensions. Estimating the income these assets will generate over the course of your retirement can be challenging. Fortunately, financial advisers have tools, such as cashflow modelling, to help.

Cashflow Modelling

Cashflow modelling is an invaluable tool that forecasts your financial future by mapping out your income, expenses, and assets over time. It can help you:

- Determine sustainable withdrawal rates: Understand how much you can withdraw from your pension without risking running out of money.

- Identify shortfalls: Determine if additional savings or investments are needed to reach your desired retirement income.

- Test different scenarios: See how changes in variables like inflation, investment returns, or life expectancy could impact your retirement.

This comprehensive approach provides clarity and allows for informed decision-making, helping you achieve financial security in retirement.

Maximising Your UK Pension Abroad

If you have UK pensions but live abroad, it’s important to explore options that could help you maximise your retirement income. Two popular choices are:

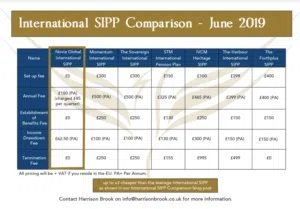

1. International SIPP/UK SIPP

An International SIPP can offer consolidation and flexibility in managing your UK pension while living abroad. It allows you to keep your pension in the UK, under UK regulations, but with greater control over your investment choices and the ability to tailor your withdrawals to your needs. Capital can also be held in most major currencies, and drawdown can occur in your local currency if required such as EUR or USD.

2. QROPS

A QROPS can be beneficial for expats who plan to stay abroad permanently with larger UK pensions and may have concerns regarding a potential re-introduction of the ‘Lifetime Allowance’ (LTA). If your UK pensions are also approaching the ‘Overseas Transfer Allowance’ (OTA) (a maximum of £1,073,100 or higher if you have existing pension protections in place) you may consider a QROPS given investment growth may breach the OTA in the near future. Transferring to a QROPS can be complex, so it’s essential to seek professional advice to ensure it’s the right move for you.

The Value of Professional Advice

Navigating the financial landscape of retiring abroad can be complex, but you don’t have to go it alone. A financial adviser, like Harrison Brook, can provide invaluable guidance tailored to your unique circumstances. Here’s how we can help:

- Bespoke Investment Strategies: Advisers can create a personalised investment strategy that aligns with your retirement goals, risk tolerance, and income needs, ensuring your pension works as hard as possible for you. Here at Harrison Brook we also offer a range of low-cost risk-graded model portfolios.

- Expert Knowledge of Pension Rules: With expertise in both UK and international regulations, advisers can help you minimise tax liabilities and maximise your pension benefits.

- Ongoing Support: Retirement planning doesn’t stop once you retire. Advisers offer ongoing support to adapt your strategy as your circumstances or financial markets change.

Conclusion: Plan Smart, Retire Well

Retiring abroad offers exciting possibilities, but it requires careful financial planning to ensure your UK pension can support the lifestyle you desire. By understanding the factors that affect your pension’s adequacy, using tools like cashflow modelling, and exploring options like International SIPPs or QROPS, you can maximise your retirement income. Consulting a financial adviser like Harrison Brook can provide you with the expertise and support needed to secure a comfortable and fulfilling retirement abroad.