Are you looking for the best International SIPP out there? Retirement planning has always been one of the most complex areas of financial planning. With so many different solutions available, all with differing features, picking the product that universally suits your needs can quickly become overwhelming. Add in the fact that you may have moved abroad, potentially hold different pots with different providers in several countries, and the situation becomes even more confusing.

So as an Expat, what are your options and what should you be looking for in a pension?

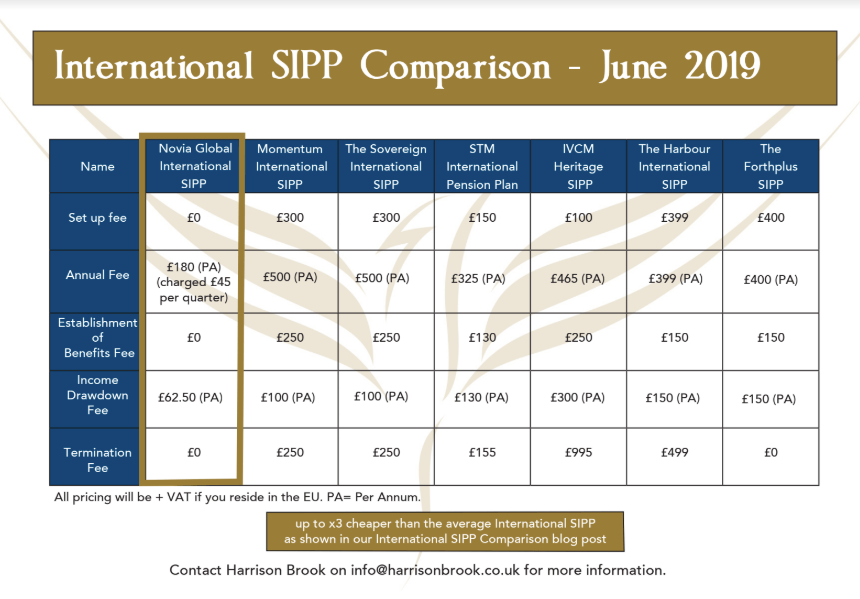

Value for money – broadly speaking, most international SIPPs offer the majority of the same features. However, there is a huge disparity between their costs involved

Easy to manage – you should look to consolidate existing pension pots in one, easy-access product, which you can view and manage 24/7

Portability – with people moving abroad more than ever, it has never been more essential to ensure your provisions are flexible, and can be accessed internationally

Fee based – the vast majority of offshore financial advisers still operate on a commision based structure. This is an outdated approach and can drastically reduced investment returns over the years

Multi-currency – living a transient lifestyle demands flexibility. You should be able to hold different currencies, and drawdown in different countries to match your lifestyle

Transparency – receiving advice from a restricted adviser, i.e. one who can only recommend you a limited number of products and pension funds, creates a conflict of interest. Independent financial advisers will assess the whole market and a wide range of investment options, without taking commissions from providers

The Novia Global International SIPP

This SIPP was launched to disrupt the international SIPP market, undercutting the market competition by up to 3x in costs. Its aims are to meet the requirements for a flexible, transparent, cost effective and tax efficient vehicle in the international retirement space. In addition, the post pensions freedom legislation has seen the restrictions lifted on enforced annuity purchase as well as the removal of the so called pensions death tax. This, coupled with the huge demand in the offshore markets for increased transparency has led to a significant demand for an International SIPP pension plan.

With a £0 set up fee, and an annual fee of £180 per annum, the Novia International SIPP is 40% cheaper than it’s nearest competitor, whilst offering everything you’d want from a SIPP.

At Harrison Brook, we are completely independent and not tied to any product nor provider.

However, in the international advice space, the Novia SIPP is a clear winner, drastically undercutting its competitors whilst offering a superior service to clients.

If you’re an Expat, or looking to move abroad and would like to discuss your options, the first step should be to speak to a regulated independent financial adviser.

Expat finance isn’t straightforward, but at Harrison Brook we will hold your hand through the process and make it as simple as possible. We specialise in low-cost international solutions unlike the vast majority of offshore advisers. Get in touch with us today.

The information contained herein is for informational purposes only which is subject to change and should not be relied upon. You should seek advice from a professional adviser before embarking on any financial planning activity.