Interested in a Novia Global Review 2025? For expats seeking a cost-effective and flexible pension solution, the Novia Global UK SIPP remains one of the most competitive options available in 2025. With multi-currency functionality, an extensive range of investment choices, and access to discretionary fund management (DFM) solutions such as Harrison Brook’s low-cost portfolios, Novia Global stands out against other international SIPPs. In this review, we explore what makes the Novia Global SIPP a top-tier option and how it compares to competitors like IFGL, iPensions, and Alltrust.

Why Choose the Novia Global UK SIPP?

1. Flexible Access

One of the most important benefits of the SIPP is the ability to use flexi-access drawdown, even as an expat. This means that you can set up regular payments or take money out when required on an ad-hoc basis. Many UK pension providers don’t provide this flexibility to non-uk residents.

2. Multi-Currency Platform

One of Novia Global’s standout features is its ability to hold and trade in multiple currencies, including GBP, EUR, USD and more. This is particularly beneficial for expats who want to mitigate currency exchange risks and manage their retirement savings in their preferred currency.

3. Extensive Investment Options

The Novia Global SIPP provides access to a vast array of investments listed on the Novia Global Investment Platform, including:

- ETFs and mutual funds

- Equities and bonds

- Managed portfolios

This means your pension can be managed in line with your specific needs and risk tolerance.

4. Cost-Effective DFM Solutions

Novia Global allows expats to use discretionary fund management (DFM) services, including Harrison Brook’s low-cost portfolios. This ensures that clients benefit from professionally managed investments at low fees, helping to optimise returns over time.

5. Protection

The Novia Global UK SIPP is a UK FCA authorised firm, meaning it has to meet strict regulatory standards in order to ensure your funds are managed appropriately. The pension assets are legally separated from the company’s own assets, and the SIPP falls under the Financial Services Compensation Scheme (FSCS) which provides compensation up to £85,000 in the event that a SIPP provider or investment firm fails.

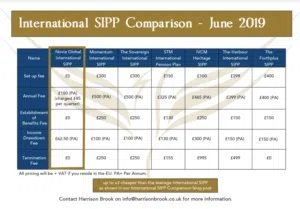

Novia Global vs. Other International SIPPs: Cost Comparison

When comparing Novia Global to competitors like IFGL (Isle of Man), iPensions SIPP, and Alltrust SIPP, here’s how the general costs break down:

| Cost Component | Novia Global UK SIPP | IFGL SIPP | iPensions | Alltrust |

| Setup Charge | £0 | £350 | £0 (Platform SIPP) / £300 (Adviser SIPP) | £99 (online) / £300 (paper) |

| Annual Trustee Fee | £240 | £500 – £600 | £200 (Platform SIPP) / £550+ (Adviser SIPP) | £330 (Oasis SIPP) / £650 (Full SIPP) |

| Platform Fees | 0.34% per annum (reduced subject to pension size) | 0.4% per annum (Ardan Platform) | 0.35% per annum | 0.15% per annum (Platform One) + custody costs |

| Can I use a discretionary fund manager? | Yes, only 0.15% per annum | Yes, higher (£600) trustee fee applies + DFM Fee | Adviser SIPP only, DFM Fee applies | Yes, DFM fee applies |

The Novia Global fees compare favourably to many international SIPP providers, particularly for expats seeking a low-cost and flexible solution.

About Novia Global

Novia Global is a well-established and highly regarded financial services provider, regulated by the UK Financial Conduct Authority (FCA). Known for its transparent pricing, robust investment platform, and strong customer support, it remains a top choice for expats looking to manage their retirement savings efficiently.

Novia Global Review 2025 Final Verdict: Is Novia Global the Best SIPP for Expats?

For expats looking for a cost-effective, flexible, and highly regulated UK SIPP, Novia Global is one of the best choices available in 2025. With multi-currency options, a wide range of investments, and access to cost-effective DFMs like Harrison Brook’s low-cost portfolios, it provides an excellent solution compared to other international SIPPs like IFGL, iPensions SIPP, and Alltrust SIPP.

If you’re considering the Novia Global UK SIPP, Harrison Brook can help guide you through the process and ensure you maximize the benefits of your retirement planning.

Get Expert Advice on Your SIPP Today

If you’re an expat and want to explore whether the Novia Global UK SIPP is the right fit for your financial goals, speak to a Harrison Brook adviser today for personalised guidance.