UK Pension Transfer to Canada – Is it still possible?

Introduction:

Canada is a top destination for British Expats with a reported 600,000+ choosing to live in the country.

With amazing natural beauty, excellent health care and education systems, there are many reasons British Expats are choosing Canada over and above other expat hotspots.

But what happens to their UK personal & private pensions, defined contribution (DC), and defined benefit (DB) company schemes once they have moved? Is a UK pension transfer to Canada still possible?

Situation Background:

Throughout our series of blogs on transferring your UK pension to Canada, there has been and it continues to be a changing market place. As we discussed in our ‘No Canadian QROPS‘ blog, in February 2017 the UK HMRC removed all Canadian recognised ROPS (formerly QROPS – Qualifying Recognised Overseas Pension Scheme) schemes in Canada. Further to this on the 9th March 2017 the HMRC also brought in a new tax the ‘Overseas Transfer Charge‘ (OTC). This meant that any British Expats which were non-EEA residents would be liable to a 25% tax charge unless the country in which they were transferring the pension had a recognised ROPS in that specific jurisdiction. Given that all the Canadian ROPS schemes were delisted, this resulted in a large drop in transfers for Canadian expats usings QROPS or now ROPS for their UK pension transfer to Canada.

This saw a huge rise in the use of SIPP and International SIPP transfers to facilitate Canadian expats, consolidating and managing their UK pensions.

Canadian ROPS/Canadian QROPS RRSP Listed Again:

This is a question that has been raised a lot in enquries with Harrison Brook but also on many message forums. Would the HMRC recognise Canadian schemes again?

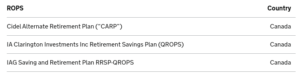

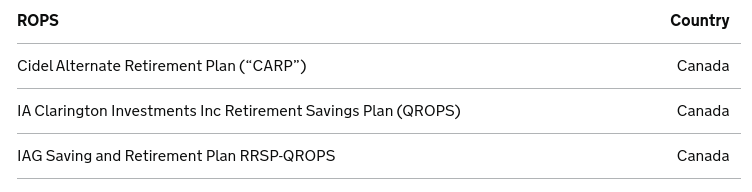

And in short, the answer is yes. Recently several schemes have been listed by the HMRC as per the breakdown below:

Options and choices of the provider are limited, but it is now possible again to transfer a UK pension to Canada directly, and importantly also avoid the OTC 25% charge. But is it the correct option to do so?

It’s important to note that if you do complete a UK pension transfer to Canada via ROPS legislation, you won’t be allowed to take advantage of any additional benefits that a Canadian scheme could offer you, in terms of access, etc, because of your pension benefits still needing to mirror that of the rules and regulations of a UK pension. Furthermore, it would also mean that you would convert your pension on the day of transfer and on receipt from British Pounds (GBP) to Canadian Dollars (CAD) which maybe not favourable to do so. It would also cause issues if you also chose to ever return to the UK for family or health reasons.

Canadian ROPS RRSP vs International SIPP for a ‘UK Pension Transfer to Canada’

Even though Canadian ROPS have returned, here at Harrison Brook we feel retaining your UK pension within a UK solution, such as an International SIPP to facilitate UK pension consolidation, currency diversification (with a CAD cash account and investment holdings available) and flexible access drawdown to still be the most prudent solution to protect your UK pension from future legislation changes or delisting of the Canadian ROPS solution again.

Every client’s situation is unique, and it is vital for you to understand what option would suit your individual circumstances best for a UK pension transfer to Canada. Here at Harrison Brook, we are ‘fee’ only advisers (no commission taken), impartial and our initial consultation is at no cost. To fully understand your options please feel free to contact me directly via our instant chat function or get started.

The information contained herein is for informational purposes only which is subject to change and should not be relied upon. You should seek advice from a professional adviser before embarking on any financial planning activity.