Investing in a crisis

Although there has been much talk about a global pandemic in recent years, the question is no longer “What if?”, but “Now what?” The past few weeks have been, without doubt, unprecedented in modern financial history. The speed of the decline in global markets last month caught even the most experienced investors off guard. But is investing in a crisis a good idea?

This crisis, when compared to previous financial crises, has not only left people fearing for their portfolios, but also and more importantly, fearing for the health and safety of their families and friends. The coronavirus pandemic has left everyone questioning how and when we will all get through this crisis.

The Great Lockdown

More than a third of the world’s population is now under lockdown or some form of restrictions. Although some countries are now beginning to ease some of the restrictions, opinions are varied as to how the recovery will look.

The WHO stated that despite all the personal and economic pain the coronavirus has caused, it is too soon to get back to normal in many places. Any premature attempts to restart economies could trigger secondary peaks in COVID-19 cases. We have seen some evidence of that, although relatively small, in Singapore. They advise that the process must be deliberate and widely coordinated.

Dr. Mike Ryan, executive director of WHO’s emergencies program, recently said, “We don’t want to lurch from lockdown to nothing to lockdown to nothing. We need to have a much more stable exit strategy that allows us to move carefully and persistently away from lockdown.”

With over 3 million reported cases of Covid-19 globally and more than 200,000 deaths, according to the COVID-19 dashboard(1), it is clear that we all must be prepared to adapt to a new ‘normal’ for at least the foreseeable future.

(1)Created by Johns Hopkins University’s Whiting School of Engineering

Economic Impact

There is widespread agreement among economists that there will be a severe negative impact on the global economy due to the coronavirus pandemic. It is too early at this stage, however, to predict the full extent of the potential economic damage.

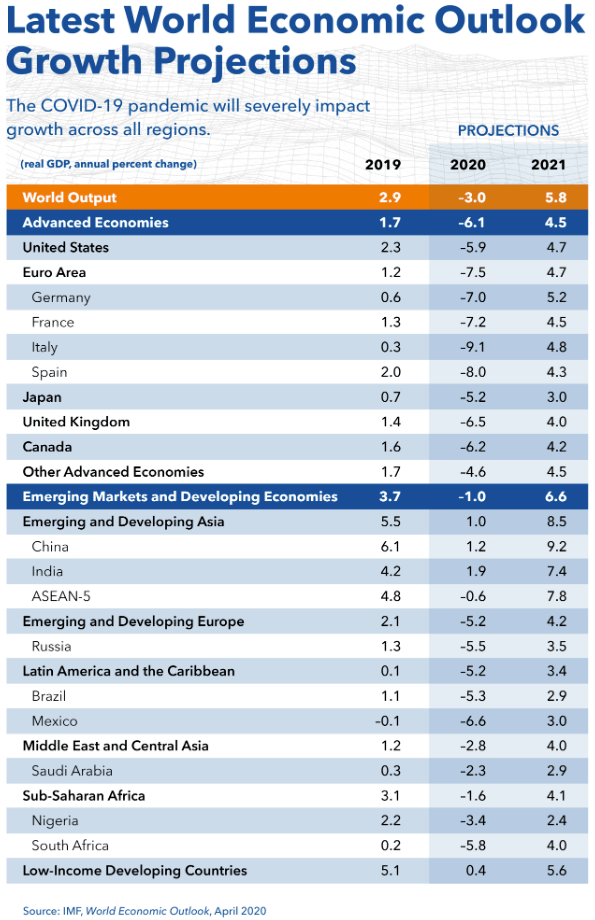

The IMF project that global growth in 2020 will fall to -3 percent. This is a downgrade of 6.3 percentage points from January 2020. This is working under the assumption that the pandemic peaks in the second quarter for most countries in the world and recedes in the second half of this year. This makes the Great Lockdown far worse than the Global Financial Crisis in 2008-9.

Reuters recently polled over 5o economists as to their forecasts of the impact to the global economy as a result of the coronavirus pandemic. Of the economists polled, there was a wide range of forecasts. Some forecast the world economy will shrink as much as 6% in 2020. Others predicted there would still be some small growth of around 0.7%. Across the forecasts, the average was a 1.2% contraction.

Only time will tell, of course, but the question that everyone is asking now is what the recovery will look like and when will it come?

Want to find out more?

Economic Outlook

The IMF (International Monetary Fund) has stated that assuming the pandemic fades in the second half of 2020, they project global growth in 2021 to rebound to 5.8 percent. (see table below)

This also assumes that global policy actions are effective in preventing widespread corporate bankruptcies, extended job losses and system-wide financial strains. They are, however, predicting that the cumulative loss to global GDP over 2020 and 2021 from the pandemic crisis could be around 9 trillion dollars, greater than the economies of Japan and Germany, combined.

The Great Recovery

There are many scenarios of how the recovery will look and again, opinions are varied among economists. Will be it a V?, a U?, or maybe a W? Can we expect a bounceback, a slow-burn recovery or relapse?

‘V’ – Would be the best case outcome. This is when you see a rapid decline followed by an equally sharp recovery. Second quarter contraction could see unprecedented figures, but with over $10 trillion of fiscal and monetary stimulus packages, this could aid a swift rebound.

‘U’ – Is when the recovery would take more than a couple of quarters. The impact of the lockdowns could last for a while, even after they are lifted, as they will be gradual with social distancing continuing to be a factor. When you consider that economies have suffered a faster and deeper contraction compared with the global financial crisis (2008-9), this may be the likeliest outcome.

‘W’ – Indicates a Double-dip. The easing of lockdown restrictions could initially boost economic activity, but when the effects of unemployment and corporate bankruptcies start to filter through, economies could decline again. A second wave of infections, as seen in some Asian countries, would also have an impact.

Despite the prevailing volatility, the markets appear to have ‘normalized’. In other words, there doesn’t seem to be indiscriminate selling across the board at the moment. Investors are seeking assets that will inevitably do well from this pandemic, i.e. technology (Zoom), medical & research companies (Gilead Sciences) and entertainment/media companies (Netflix).

Although there are a multitude of opinions as to how the recovery will look, there does seem to be a consensus among analysts and investors that now could be a good time to capitalise on investment opportunities. Some are even saying we are looking at a once in a decade opportunity…

Investing in a crisis – What should I do?

Although we are seeing a few green shoots of optimism and some are eager to declare the worst is now behind us, fear remains widespread. In the famous words of Warren Buffett, “Be fearful when others are greedy, and be greedy when others are fearful” is perhaps more true today than at any other time in recent history.

However, we are in unprecedented times, so having a full understanding of the impact of the current situation and the investment options going forward is vital. The first step, therefore, would be to take sound and independent financial advice.

Buy or Sell?

No one can reliably predict when we will hit the bottom, or if we already have. We must also be mindful that the recent ‘bounce’ in equity markets may not be sustainable. Successful investors, however, do not buy when prices are high and sell when prices are low.

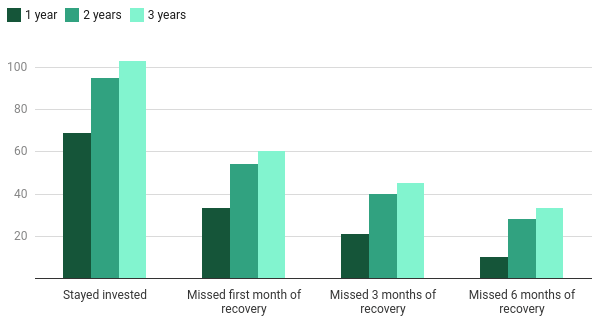

Although we do not know how long the pandemic will last, it is almost impossible to try and ‘time’ the market. The chart below highlights that during the global financial crisis in 2008, those who stayed invested recorded double the returns of those who moved to cash for as little as three months. This data is based on the returns of the S&P 500, and shows that it is ‘time’ in the market that is important.

Some companies will sadly not survive this crisis and others will emerge stronger. While the short term outlook might look bleak, evidence suggests that over the long-term, businesses and the stock market will grow.

I think we can all agree that there is no way anyone can reliably predict when the stock markets will recover. However and perhaps more critical in the current situation, is Warren Buffet’s warning that the markets would turn long before “either sentiment or the economy turns up.” He went on to add, “if you wait for the robins, spring will be over.”

Spring is now upon us literally and perhaps financially…

Next Steps

You may be a seasoned investor with either a regular savings plan, an active or ‘closed book’ portfolio that is no longer being serviced, or a new investor looking to save and invest for your future.

Harrison Brook is Europe’s leading independent financial adviser. We offer a complimentary first consultation and comprehensively advise clients on a range of investment opportunities, retirement and pension options and overall financial planning strategies.

We are available, so get in touch today!

Want to find out more?

The information contained herein is for informational purposes only which is subject to change and should not be relied upon. You should seek advice from a professional adviser before embarking on any financial planning activity.