If you are reading this article then it will be no surprise to you that the Balfour Beatty pension scheme has been experiencing serious financial difficulties. At Harrison Brook, we receive inquiries from some of the 18,308 deferred members wishing to leave Balfour Beatty pension scheme.

Want to leave Balfour Beatty Pension scheme?

As such, we have created this dedicated article to helping people understand the pension transfer options available to them. As of 2014, the Balfour Beatty’s pension scheme deficit stood at £357m.

At Harrison Brook, we have been monitoring the situation closely for our clients and will continue to do so. This week Balfour Beatty delayed a planned £85m pension deficit payment, instead of staggering this over the next eight years.

This comes just weeks after Balfour Beatty canceled a proposed £200m share buyback after issuing a sixth profit warning in two and a half years. Put simply, the prospects are not good for many scheme members who wish to leave Balfour Beatty Pension scheme.

How to leave Balfour Beatty Pension Scheme

If you have savings in an existing UK pension fund but are considering retiring abroad, you may be wondering just how easy it will be to access these funds. The dreams of a more relaxed lifestyle or the attraction of lower tax could soon fade if you have to work around pension rules more relevant to the UK.

Transfer UK Pension – QROPS or SIPP

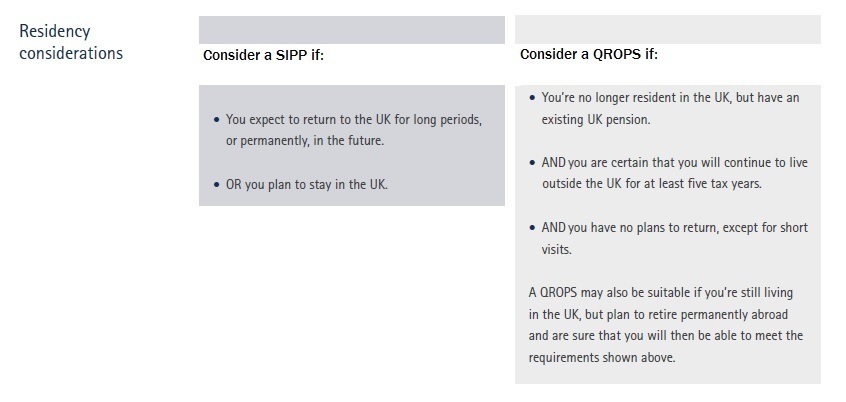

However, if you already live outside the UK, or you’re planning to move overseas shortly for a period of five years or more, you can use a QROPS to transfer your pension arrangements abroad. If your intention is to retire in the UK a SIPP structure would be more suitable.

What are the benefits of a QROPS?

Compared to general UK pension rules, a QROPS could offer you these advantages (subject to local pension rules):

- It could reduce the income tax payable on the income from your pension

- If you die, your family will be able to inherit your pension benefits free of the lump sum death benefits charge.

- A wider choice of investment opportunities. Particularly useful if you want to invest in different assets and currencies depending on where you plan to retire, rather than UK-biased choices. Nevertheless, the pension income payments can be matching the currency you are spending.

- 30% Pension Commencement Lump Sum – through a QROP based structure an increased % percentage is available as your tax-free lump sum payment.

- Ability to minimize the impact of your UK lifetime allowance

- Dual Taxation Agreements (DTA’s) are an option in place between your chosen retirement location and a QROP jurisdiction – which means the investment aspect of your pension will grow free of any taxation and pension withdrawal payments are paid gross.

- QROP Investment Portfolio can be structured for capital growth or income generation – get your capital working harder for you.

- Consolidate various/several pension schemes into one manageable plan for easy management.

- From April 2015, certain QROP jurisdictions (Malta & Guernsey) will allow full flexibility when the UK regulations are effective.In addition, QROP jurisdictions will allow full access to pot value above your tax-free lump sum allowance. This means QROPS will not restrict you to benefit provision.

What should you consider before choosing a QROPS?

- Residency considerations – do you expect to return to the UK to retire or for long periods of time in the future? A SIPP may be more suitable in this situation.

- Existing pension arrangements – is your current pension plans worth less than £20,000? Are you current pensions defined benefit schemes? Do your existing schemes include benefits such as spouse’s pension, life cover, competitive charges? Our team would assess any pension transfer in a feasibility study, helping you understand what your current scheme offers in details.

Using a QROPS or SIPP to provide for your family

UK annuities usually end when the recipient dies, leaving no extra money for family or beneficiaries. With a QROPS or SIPP, since you don’t need to buy an annuity, your fund won’t vanish when you die. Instead, you can pass it on to your loved ones.

Helping you make the best choices for UK Pension Transfer:

UK pension transfers is a growing market, and new providers are appearing regularly. Talk to a Harrison Brook Financial Adviser to make sure you choose the most appropriate jurisdiction and provider for your needs. Additionally, your SIPP or QROPS will include different kinds of investments. Therefore, it is crucial to speak to a Financial Adviser to match your investment goals.

Why choose Harrison Brook for your UK Pension Transfer?

- QROP & SIPP structures available depending on your situation

- We offer discounted QROPS & SIPP fee structures through our online advice system – we pass the savings onto you

- Will never transfer a pension unless 100% in the best interests of the client

- The UK regulated adviser

- Ongoing advice and management

- No restrictions on client location globally

- Access to institutional high rate deposit accounts and structured fixed return products

- Access to funds that have been handpicked by investment specialists in model portfolios. Not to mention, which we will structure for capital growth, income generation or both.

How do you take the first step?

To get the latest valuations of your pensions and to discuss a UK Pension Transfer France with a UK regulated adviser based in France, including the benefits and if a QROP or a SIPP is the solution for your pension planning.

Click Get Started, speak to an adviser for free, no obligation, financial analysis, and information.

Learn how to leave Balfour Beatty Pension Scheme by contacting us.

The information contained herein is for informational purposes only which is subject to change and should not be relied upon. You should seek advice from a professional adviser before embarking on any financial planning activity.