Moving abroad with your family? How about Moving to Brunei…

Most people have heard of Brunei however very few could place it on a map. Yet there are currently around 160,000 expats residing there, making up 40% of the total population. Is moving to Brunei a good idea? For those that visit, they would find the following;

A tiny jungle covered country with one of the highest standards of living in the world and a booming economy thanks mainly to its flourishing oil and gas industries. The lions share have been seduced by the proposal of lucrative employment packages, tax-free income and comparatively low cost of living.

Culture

The culture will be a shock to any expat arriving in Brunei due to the strict Islamist laws. Any expat moving to Brunei should be aware of the local standards and always look to adhere to them. Furthermore, women should dress in moderation and stay away from physical contact with members of the opposite sex. Any compromising behaviour between non – Muslims and Muslims can lead to serious punishment and deportation.

Healthcare

Brunei has one of the best healthcare systems in the world, rates are low for expats whilst Bruneians receive care for free. For expats covered by health insurance, there are a sizeable number of very good private hospitals also available.

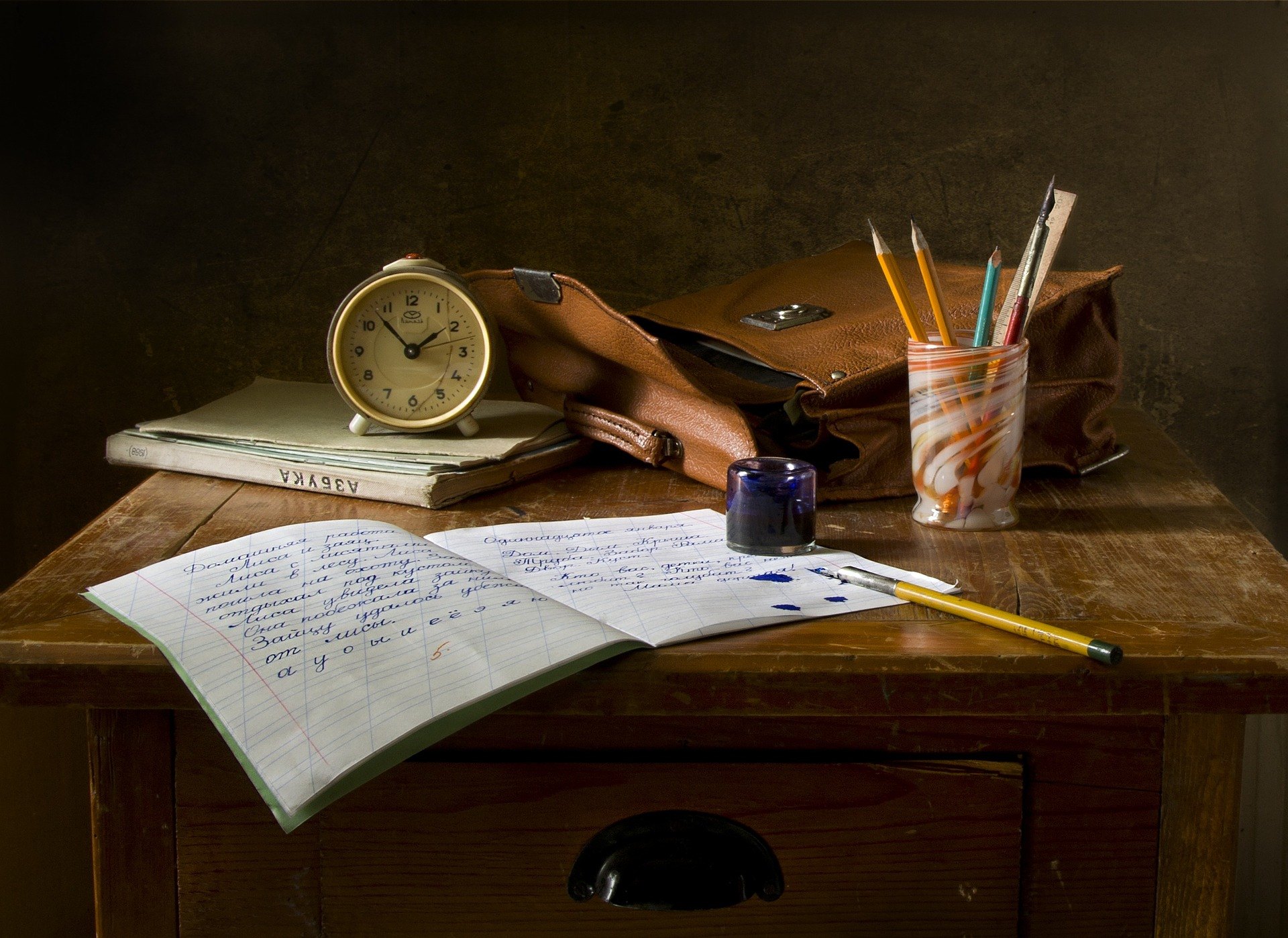

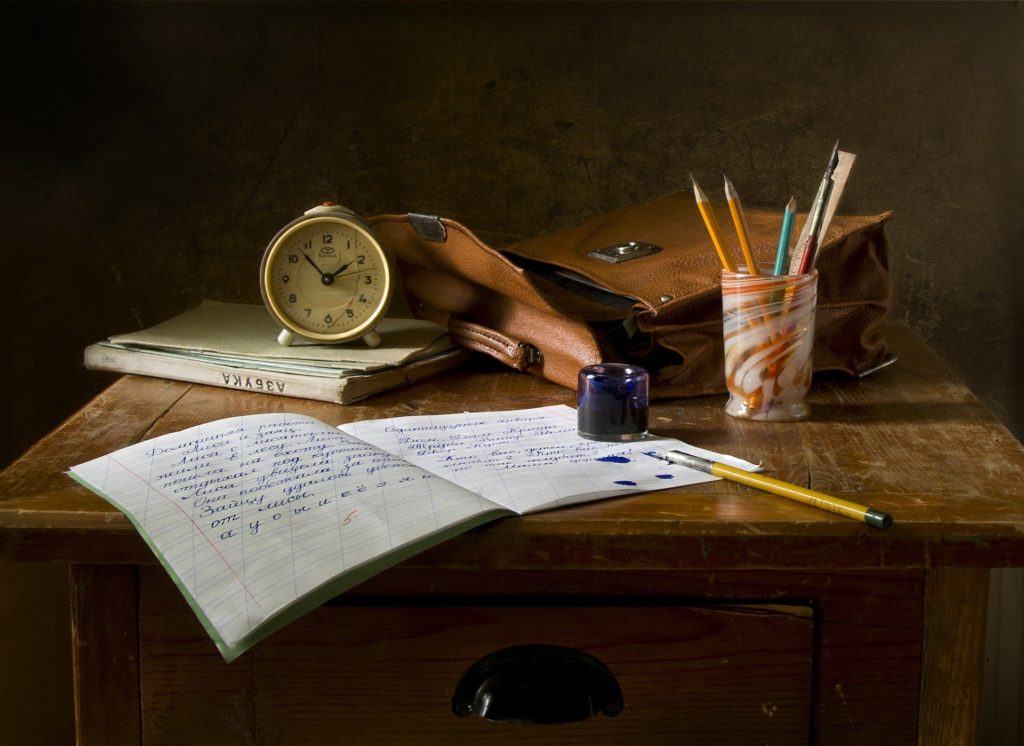

Education

Famed for having one of the worlds best educational systems and with very low crime rates there are many pros to living in Brunei. Although the educational system is relatively young, thanks to large government investment it maintains to be a world leader. Expats generally tend to send their children to the international schools in the capital city of Bandar Seri Begawan. But the high standard doesn’t come cheap, with tuition fees averaging over $8000 pa for the top schools.

International Savings and Retirement Planning for Brunei and beyond

One issue when moving to Brunei and beyond is continuing your pension contributions. The moment you leave the UK or wherever you are making pension contributions, there is no tax relief on local pension solutions. Usually, you are not allowed to continue contributing once tax resident in another country. Companies pay well but often don’t offer the same appealing pension plans, especially if in Brunei for a limited period of time.

There are various options and plans available to suit every person’s unique situation when starting an international savings plan. By setting up an effective, tax efficient, wealth accumulation Savings Plan you can truly fulfill the dreams and aspirations you have in your retirement, with a much greater level of comfort.

Where you wish to en-cash the plan? and does it remain in a tax efficient investment area, growing tax free no matter where you may move next? are important factors that need to be considered.

Harrison Brook offers discounted international savings plans through our online advice system passing on the savings to the customer. Our cross-border specialists are familiar with needs and requirements of expatriates abroard and have access to savings plans from a broad range of leading banking institutions. With access to investment specialists’ hand-picked funds, no restriction on client location and ongoing advice and management irrespective of future career movement, get in touch today.

Although the many expats moving to and living in Brunei will need to adjust to both the culture and environment. The quality of living, combined with endless opportunities and widely spoken English make Brunei a destination well worth visiting. With a little financial foresight and planning, every objective can be achieved and catered for.

#bruneiexpats #livinginbrunei #internationalsavingsplan

The information contained herein is for informational purposes only which is subject to change and should not be relied upon. You should seek advice from a professional adviser before embarking on any financial planning activity.