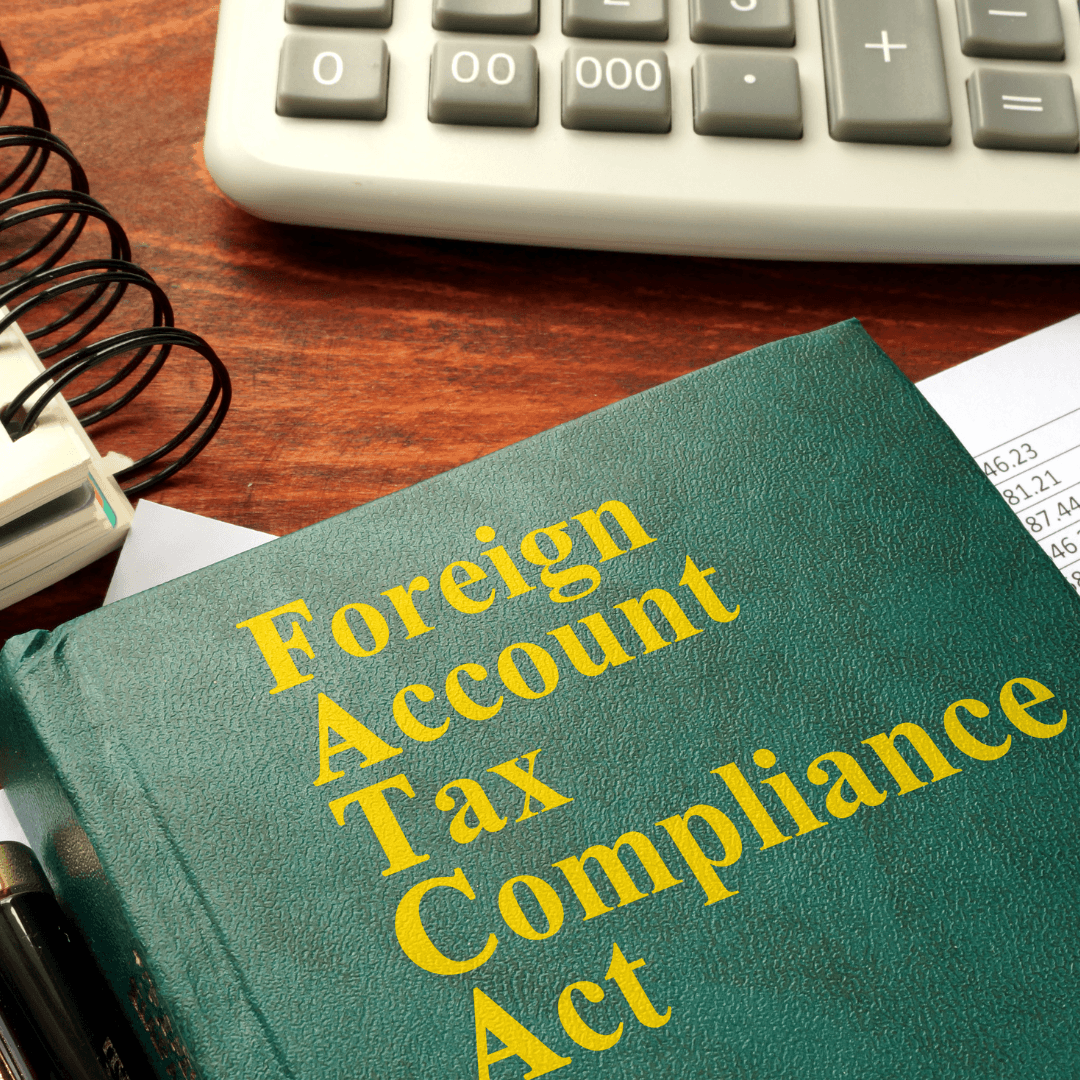

What we're about

Getting results

Our reputation is built by winning trust, but also delivering on our promises. We love working closely with our expat clients, giving sound financial planning advice to leverage wealth and help grow their investment portfolios.

Read more »